Our subscription plans are designed to cater to individual users as well as teams of all sizes. Here’s a quick overview:

Per-User Plans

Ideal for individuals or small teams, these plans follow a sliding scale — the more users you onboard, the better the per-user rate.

Multi-Year Discounts

For those ready to commit long-term, we offer biennial and triennial plans at discounted rates. These not only secure uninterrupted access but also deliver meaningful savings over time.

Enterprise / Company-Wide Plans

For organisations with 15 or more users, our enterprise plans offer fixed pricing tiers and unlimited flexibility — users can be added anytime without incurring additional per-seat costs.

These plans are particularly well-suited for teams spread across departments or geographies, and offer significant cost advantages over standard per-user models.

If you’re looking to scale access or drive broader adoption across your team, enterprise plans are the most seamless and cost-effective route. We’d be happy to tailor a proposal that aligns with your needs.

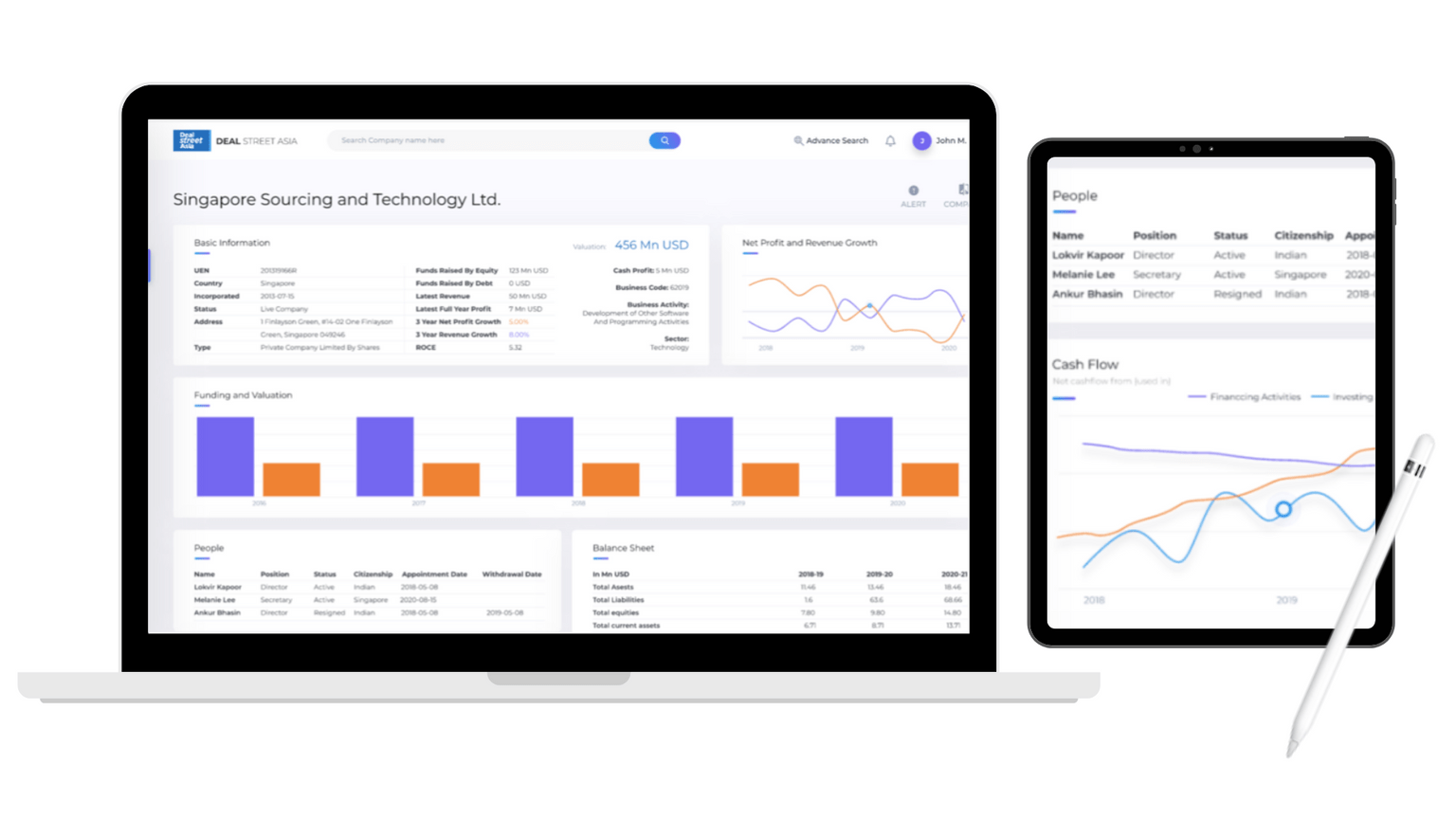

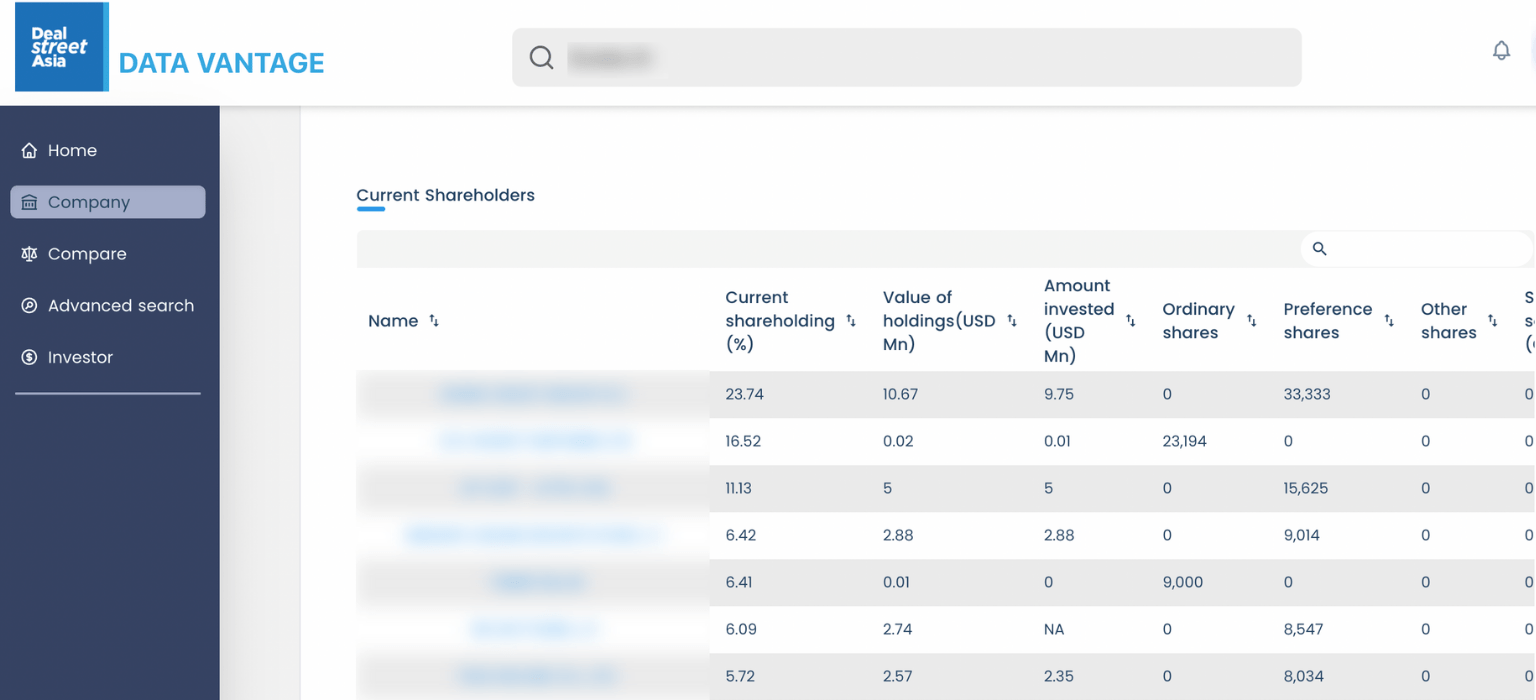

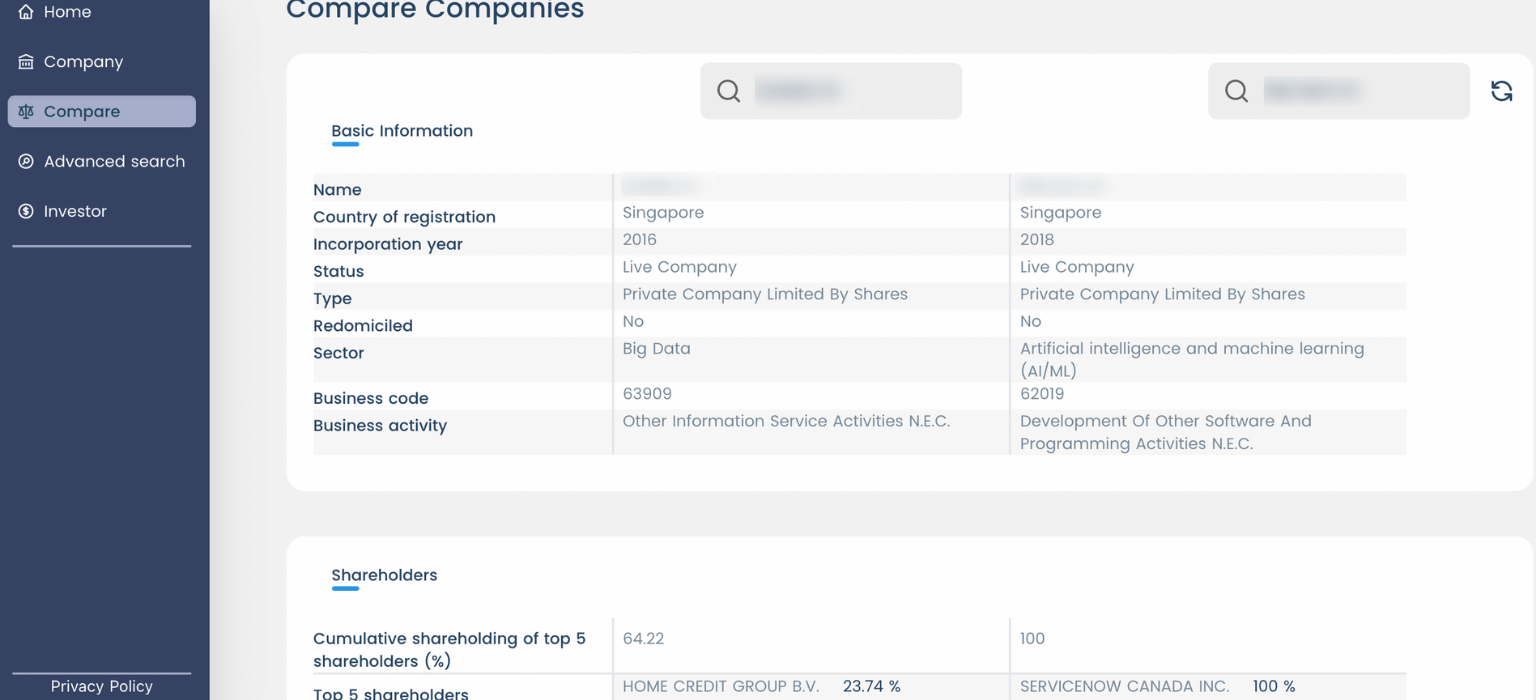

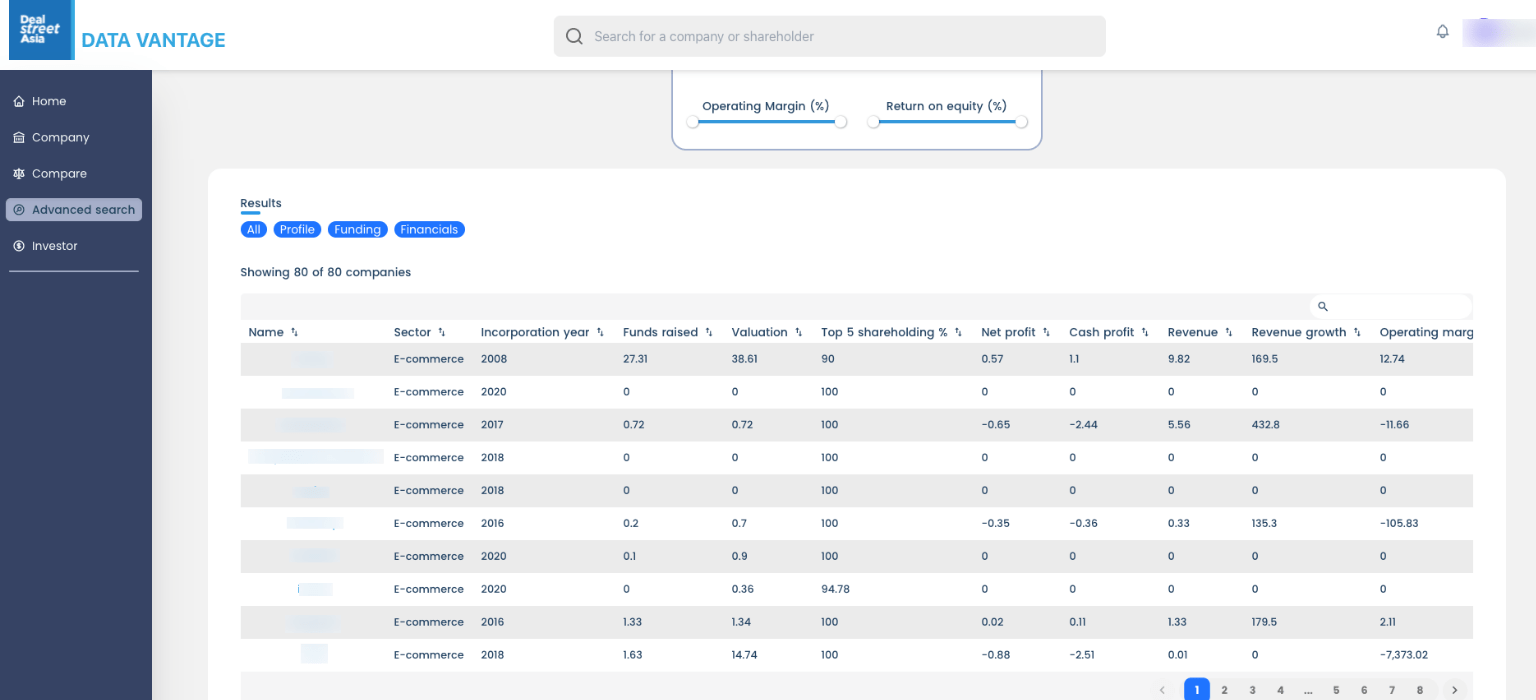

Curious to explore how DATA VANTAGE can support your goals? Simply fill out the form to request more details — or let us know if you’d like to schedule a complimentary trial or a live demo. We’re here to help.