The year started out with all of us circumspect as the pandemic dragged on. But, as we tracked the deals and fundraising in the space, it became clear that both businesses and their investors, looking beyond the near-term challenges, have their eyes on the supercharged growth that Southeast Asia, India and Greater China promise.

Our most-read stories this year brought you the news, data and trends that showcased and underlined this growth story. Here’s to a stronger 2022!

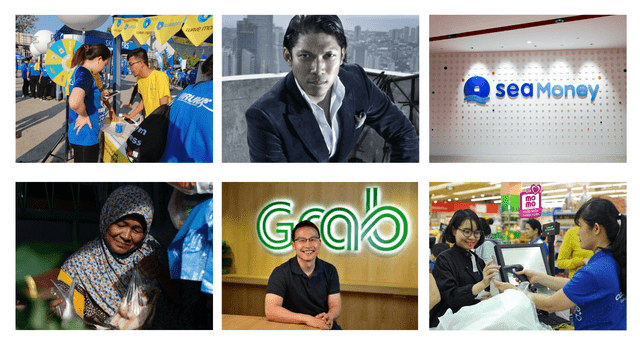

- Sea Group firms up digital payments play in Indonesia with Bank BKE acquisition

- Is Grab’s weak Nasdaq debut the cost of overvaluation, or just bad market timing?

- Family of top Indonesian magnate owns 51% in ShopeePay, and that makes all the difference

- Temasek said to be creating new holding firm to house cluster of investment units

- Vietnamese e-wallet MoMo raises over $100m in Series D round led by Goodwater Capital, Warburg

- SG luxury goods platform Reebonz co-founder Daniel Lim departs, angry sellers demand payment

- Will Grab’s flywheel strategy take off?

- Cautious investor to optimist president: How Ming Maa sped up Grab’s journey to the top

- Bangladeshi retail tech startup ShopUp raises $74.4m from Valar Ventures and others

- Grab looks to partner Indonesian banks; may invest in Bank Fama, Bank BRI Agro

- SG’s Fullerton Healthcare in talks to exit business, invites bids from investors

- Emtek Group buys minority stake in Grab’s Indonesia unit in sign of deepening alliance

- [Updated] Philippines’ NBI probes Robbie Antonio over Revolution Precrafted’s dubious deals

- Ant Group’s $73.5m investment in Myanmar fintech Wave Money fails to materialise

- Why Alibaba-owned Lazada is doubling down on payments in Southeast Asia

- Southeast Asia mints 19 unicorns so far in 2021, could surpass previous decade’s total

- Indonesia’s Sinar Mas Group in talks to acquire DANA from Emtek

- SE Asian GPs spot big promise in continuation funds amid pandemic drag

- As big tech enters the race, PE-VCs look for next big thing in China’s growing EV market

- China’s nascent trend of continuation funds likely to expand as ‘exit remains king’

- Investors bullish on China even as Beijing’s tech clampdown weighs on IPO exits

- PAG doubles down on PE deals in China, despite concerns over excessive regulation

- Sequoia Capital mops up $3.6b so far for latest India, China growth funds

- Temasek’s portfolio value may receive lift from IPO-bound Indian assets this year

- Tencent continues India investments despite FDI curbs on Chinese money