We are happy to announce six more fireside chats featuring the region’s most influential deal-makers and news-makers from the tech startup and investor community. At DealStreetAsia’s Asia PE-VC Summit 2021, we will bring together the top private equity, venture capital and startup executives from Southeast Asia, India and China to take us through key themes, opportunities and challenges from close quarters.

? Private equity and the next generation of consumers

Even before the pandemic, the consumer sector was undergoing key shifts driven by changes in demographics and the digitalisation of business models. The COVID-19 pandemic and ensuing restrictions have accelerated existing trends, and pushed businesses to take stock, and rethink operating models and value propositions.

What matters most to the consumers of tomorrow? How are private equity firms approaching the evolving market landscape? Where are the opportunities that private capital can tap into?

As an experienced investor in the consumer sector, with more than three decades of experience in building enduring brands, L Catterton is at the heart of these questions. The firm has $28 billion in equity capital under management and investment professionals globally. Bhagat, who leads the team in Asia out of Singapore, will share his perspectives on creating value amid the changing consumer landscape.

? Straddling real estate, healthcare and tech bets: The pillars that will remake Lippo Group

The Lippo Group is viewed as a proxy for the state of the Indonesian economy. Its performance across key business verticals – real estate, private healthcare, and its tech bets – place it at the centre of Southeast Asia’s largest economy. The group has been in the news recently with ride-hailing and payments decacorn Gojek investing in its retail business, and Axiata Group Bhd., Malaysia’s biggest wireless carrier, being in talks to pick up stake in its portfolio company PT Link Net.

In 2019, in a surprise move, John Riady, grandson of Lippo founder Mochtar Riady, became the CEO of IDX-listed Lippo Karawaci, and was tasked with restoring the property developer’s scandal-tainted image. Lippo Karawaci is also the majority shareholder of Indonesian private healthcare services provider Siloam International Hospitals and owns a stake in Lippo Malls Indonesia Retail Trust listed on the Singapore Exchange.

As Lippo CEO, John Riady has focused on concentrating on the sweet spots in real estate and healthcare businesses. He is betting on macro drivers like urbanisation and demographics, as well as the digitalisation of healthcare to spur growth at the group’s businesses.

Prior to taking over as CEO, Riady led the group’s digital efforts and investments in SE Asia’s technology sector including in e-payment platform OVO, which counts Grab and Tokopedia among its backers.

The group has made over 30 investments in Indonesia’s tech sector, which Riady believes is at an inflection point. We will hear more from Riady on how he is applying learnings from leading digital initiatives on hardcore brick-and-mortar businesses in the remaking of Lippo Group.

? The road to building a regional property marketplace leader

From a listing collapse in 2019 to raising a big-ticket sum from its storeyed backers to acquiring Australia-listed REA Group entities in Malaysia and Thailand to the latest SPAC merger, PropertyGuru has had a milestone-filled journey in recent months.

PropertyGuru’s merger with blank cheque firm Bridgetown 2 Holdings, a SPAC entity backed by billionaires Richard Li and Peter Thiel, will give the combined entity an equity value of $1.78 billion. Backed by TPG Capital and KKR, the property marketplace has joined fellow tech majors from the region to take the SPAC route.

In this chat, PropertyGuru CEO Hari Krishnan will trace the growth journey of the marketplace across multiple geographies in a largely traditional and local sector as well as its road ahead.

We will quiz Hari Krishnan about how PropertyGuru has pursued opportunities such as landing big-ticket funding, scaling up both organically and through M&As, striking a SPAC deal and the complexity of serving vastly different markets.

PropertyGuru operates property marketplaces in five of the biggest Southeast Asian economies –Singapore, Malaysia, Thailand, Indonesia, and Vietnam.

? An approach to early-stage investing, building unicorns and getting startups IPO-ready in India

As a venture capital firm, if raising money is tough, returning money to one’s limited partners is way tougher, according to early-stage investor Blume Ventures.

Set up in 2010 by Karthik Reddy and Sanjay Nath, Blume has backed over 100 startups, including Dunzo and Instamojo, across its 10-year history through multiple funds.

The VC most recently raised a Rs 350-crore (over $46 million) secondary vehicle to invest in some of its larger portfolio firms to support them for a longer tenure and to allow an exit for some of the early LPs. As part of the secondary vehicle, Blume will continue to invest in at least half a dozen of these portfolio firms including GreyOrange, Turtlemint, among others. Blume is also nearing the deployment cycle of its $102-million third fund, even as it is looking at ways to stay invested in its growing portfolio.

Seasoned investor Nath will take us through India’s growing unicorn count, viable exit avenues for investors and the need for building sustainable businesses. Blume Ventures’s secondary vehicle comes at a time when several prominent startups in India are queueing up for a busy IPO season. We will ask Nath about what prompted the strategy to hold some of the firm’s key bets for a longer term to deliver bigger exit outcomes. Will this trend take off in India’s startup ecosystem?

? Taking AI out of science labs and creating scalable models

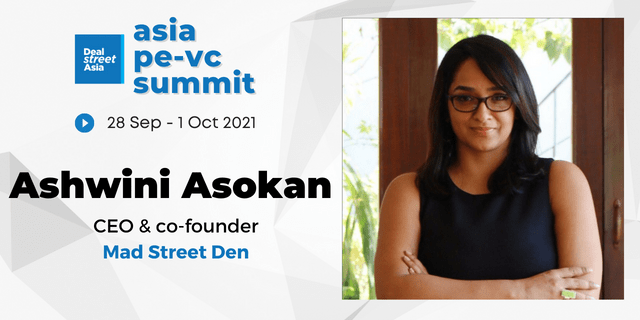

As CEO & co-founder of computer vision and AI company Mad Street Den, Ashwini Asokan believes in building models that can help millions of people across the globe to become AI natives. The company’s first vertical, Vue.ai, helps the retail industry reimagine and automate workflows while its platform Blox.ai powers businesses across education, healthcare, finance, and entertainment.

Mad Street Den’s backers include Sequoia Capital, Exfinity Ventures, KDDI – Global Brain Japan, and Rocketship VC. Ashokan, who returned to India in 2013 from the US after an 8-year stint with Intel, will talk about her journey, including launching Vue.ai after three years of deep-research, and what it takes to scale a SaaS company.

Apart from AI-led revenue growth, process efficiency and revenue/performance marketing, we will also be asking her about hiring and talent, fundraising and valuations, as well as the gender imbalances prevailing in the tech and the startup ecosystems. Asokan strongly believes that diversity is essential and has enforced a 50-50 gender policy at Mad Street Den.

? The Near Story: Leveraging data intelligence and analytics to drive digital transformation

It may be under the radar, but Singapore-headquartered Near, a B2B SaaS platform providing data intelligence on online and offline consumer behaviour, may soon emerge as the region’s next unicorn.

The company, which has been expanding from ‘East to West’ via M&As and organically says it aggregates anonymised data on 1.6 billion monthly users across 70 million places and is leveraged by 2 out of 3 Fortune 500 businesses. Near has raised $134 million from marquee investors such as Sequoia Capital, JP Morgan, Telstra and Cisco and has a presence across North America, Europe, Asia and Australia.

Shobhit, who co-founded Near along with Anil Mathews, will talk about the company’s global ambitions and the road ahead. We will also ask him about the company’s recent acquisitions: Teemo, a Paris-based location intelligence platform, that allowed Near to crack the European market and offer advanced data intelligence products, as well as California-based UM that provides mobile location data and intelligence. We will also find out more about Near’s enterprise SaaS business model, privacy-by-design principle and its Entrepreneur-in-Residence Programme. Finally, when will Near test the public markets? Do join the session to find out.

Join the conversation and network with hundreds of leading industry executives on 28 September – 1 October at the Asia PE-VC Summit 2021.

The $299 Super Saver rate, expiring 31 July, 11.59pm SGT, saves you a whopping $200 off standard admission!