Singapore-based early-stage venture capital firm Cocoon Capital has made a $30 million first close of its latest venture capital fund, Cocoon Capital III, according to an announcement.

The fund, with a target corpus of $50 million, will continue to target pre-seed and seed-stage investments in B2B software and deep tech startups across Southeast Asia.

It will also selectively explore opportunities across broader Asia and Australia, per the announcement.

Cocoon said it plans to invest in 20 companies over the next four to five years, with roughly 55% of the fund reserved for follow-on investments up to Series A.

Founded in 2016 by Michael Blakey and Klippgen, Cocoon Capital is a Singapore-based venture capital firm focusing on early-stage, digital, deep tech, and B2B companies across Southeast Asia.

It closed its second fund in mid-2019 at $22 million, exceeding an initial target of $20 million. The vehicle, launched in 2018, was backed by Vulpes Innovative Technologies Investment Company; UK-based seed fund Playfair Capital; Jani Rautiainen, co-founder of PropertyGuru; and Michelle Yong, director of Singapore’s Aurum Investments, among others.

Cocoon launched its first fund at $7 million in 2016.

The firm said Fund I and Fund II are actively returning capital to investors and achieving a leading Distributed to Paid-In Capital (DPI) in the region.

Blakey said Cocoon is steering clear of trending sectors such as consumer technology, AI, and blockchain opting instead to back startups tackling less glamorous but complex challenges in areas like enterprise infrastructure, advanced manufacturing, robotics, and healthcare.

“Fund III doubles down on that strategy. We’re not looking to build the biggest portfolio, we’re looking to build the most resilient and transformational one,” he added.

The latest fund secured commitments from returning limited partners, Blakey said, many of whom have increased their investments. It also secured support from new LPs from across Asia, Europe, and North America.

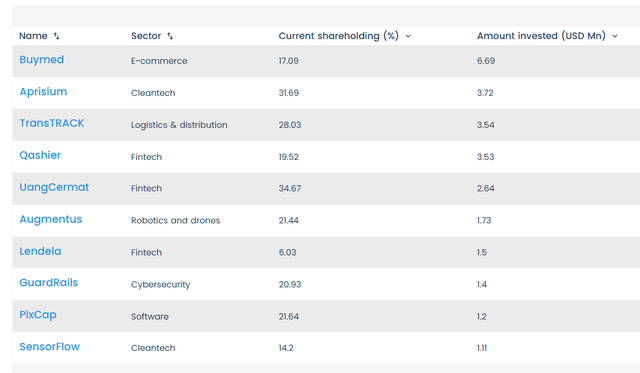

Cocoon Capital’s top portfolio firms

Cocoon Capital’s portfolio includes industrial contamination detection startup Aprisium; no-code robotics reprogramming platform Augmentus; fleet optimisation and logistics platform TransTRACK; Vietnamese digital pharma distributor BuyMed; and Bangladeshi job-tech startup Shomvob.