Greater China Deals Barometer Report: Startup fundraising hits six-month high in June

The Greater China market welcomed a dealmaking rebound as startups in the region raised over $5.6 billion in June, the highest-ever monthly deal value recorded so far this year.

The mid-year recovery rides on an industry observation that expects a number of Chinese fund managers, especially the market-driven USD-denominated funds, to return to market toward the end of 2025 or early 2026.

At $5.6 billion, the monthly deal value was up 225.5% from $1.7 billion in May. The aggregate 198 transactions recorded in June was up 15.8% month-over-month (MoM), according to proprietary data compiled by DealStreetAsia.

While macro uncertainties, geopolitical tensions, and a tepid exit landscape defined June 2024, many of the headwinds continued to linger on in the first half of 2025. Trade uncertainty continues to loom over Asia, dampening investment confidence. It remains to be seen if the dealmaking momentum will be sustained for the rest of 2025.

Overall, the first half of 2025 raised $20.4 billion through 1,197 deals. Venture investors pledged 30.1% less capital in H1 2025, although the deal count was 5% more than the same time last year.

Megadeals dominate funding scene

Megadeals or investments worth at least $100 million, emerged as a major contributor accounting for over $4 billion via eight transactions, or 71.6% of the total deal value.

Hong Kong-listed Tencent Music Entertainment Group’s acquisition plan of Chinese online long form audio platform Ximalaya for about $2.4 billion in cash and stock was the largest deal in June.

Kylinsoft, also known as Kylin Software, garnered the second largest deal of the month after snapping up around 3 billion yuan ($417.7 million) in fresh equity funding at a pre-money valuation of around 8.4 billion yuan ($1.2 billion).

Known as the homegrown developer of China’s first open-source desktop operating system, the firm aims to use the proceeds to expand its R&D and product line.

Chinese ride-sharing platform Hellobike’s new robotaxi company, which focuses on Level 4 autonomous driving R&D, safe applications, and commercialisation, was the third-largest deal of the month, after securing an initial investment of over 3 billion yuan ($417.3 million) from its founding firms.

The remaining megadeals are scattered across consumer products, automobiles, and embodied AI, among others.

List of megadeals (June 2025)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Ximalaya | Hong Kong | 2400 | Acquisition | Tencent Music Entertainment Group | Software | N/A | ||

| Kylin Software/ Kylinsoft | Shanghai | 417.7 | China National Software & Service Company Limited, China Mobile Capital Holding (under China Mobile Communications Group), an investment unit under Beijing State-owned Capital Operation and Management, CCB Financial Asset Investment (under China Construction Bank), Sinopec Capital, China Electronics Intelligent Fund Management, China Internet Investment Fund, Zhongwan Heying, Tianjin Jiwan, Zhongwan Haihe | Software | N/A | |||

| Zaofu Intelligent Technology | Shanghai | 417.3 | Ant Group, Contemporary Amperex Technology Co Ltd (CATL), Hellobike | Consumer Services | Ridesharing/Transport | |||

| Shanghai Yuyuan Jewelry & Fashion Group | Shanghai | 246.3 | BOCOM Financial Asset Investment, BOC Financial Asset Investment | Consumer Products | N/A | |||

| Cavan Auto | Beijing | 167.5 | Pre-A | Beijing Green Energy and Low Carbon Industry Investment Fund, Foton Motor, BAIC Capital, Boyuan Capital, Robert Bosch Venture Capital, Guotai Jun’an Innovation Investment, CICC Capital, Xiamen Jinyuan Group | Automobiles & Parts | Electric/Hybrid Vehicles | ||

| Galbot | Beijing | 153 | CATL, CATL Capital (Puquan Capital) | China Development Bank, Beijing Robot Industry Development Investment Fund (under Shoucheng Holdings), Jiyuan Capital | Business Support Services | Robotics & Drones | ||

| United Imaging Intelligence | Shanghai | 139.1 | A | E Fund Management, Shanghai Sitoco Assets Management | United Imaging Healthcare Technology Group, Shanghai Alliance Investment, Sun Rock Capital, Junwei Venture, Tsing Song Capital, Suzhou Capital Group, Baolan Investment, Zhangjiagang Venture Capital, Shanghai United Imaging Healthcare | Healthcare IT | HealthTech | |

| Flexiv Robotics | Shanghai | 100 | C | Shanghai Everchanting Venture Capital Management, GF Xinde Investment, Hongtai Aplus, Tsinghua Holdings Capital (TH Capital), Gaorong Ventures, eGarden Ventures, Mfund | Business Support Services | Robotics & Drones |

Investments at Series A and earlier funding stages continued to dominate in June—there were 96 transactions in the earliest funding stages, accounting for almost half (48.5%) of the deal count. Meanwhile, dealmaking close to public listing stages continued to be sluggish, with one deal being sealed at Series E or after.

Investors tap into the embodied AI bandwagon

June saw Chinese embodied AI startup Galbot secure 1.1 billion yuan ($153 million) in a funding round co-led by Chinese battery giant CATL and its strategic investment arm Puquan Capital.

Galbot’s deal signifies how Chinese firms continue to push the boundaries of integrating AI with physical systems. A wave of capital has been piling into firms in embodied intelligence, especially as the segment is mentioned under China’s 2025 Government Work Report, showcasing national support for the sector.

However, the red-hot sector has drawn concerns that Terence Ho, Greater China IPO Leader at consultancy firm EY, told a local news outlet recently that investors are being “overoptimistic” towards the sector, as the path to commercialisation remains uncertain.

Also, GPs and LPs alike have pointed out that overheated valuations could be one concern, as it could kill the returns; others cited geopolitical tensions continue to be a roadblock that hinders US LPs from investing into Chinese GPs with exposure towards the AI sector amid growing regulatory scrutiny.

One thing that is unstoppable: Chinese GPs are now heading towards an era when AI is poised to become as ubiquitous as the mobile internet once was.

Top Investor: Shenzhen Capital Group

Shenzhen Capital Group, a venture capital and private equity investment firm set up by the Shenzhen government in 1999, participated in seven deals to top the investor list. The seven investee startups raised a total of $43.5 million.

Formerly known as Shenzhen Innovation and Technology Investment Company, the firm covers equity investments, fund of funds, mutual funds, and asset securitisation, among others. It has assets under management of over 510 billion yuan ($71 billion), according to its website.

CATL and its strategic investment arm Puquan Capital, or CATL Capital, made a rare appearance on the list after the battery giant participated in three deals. The three startups, namely Galbot, Zaofu Intelligent Technology, and autonomous haulage solutions provider EACON, have together raised a total of $626.1 million.

Most active investors in China (June 2025)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Shenzhen Capital Group | 7 | 43.5 | 4 | 3 |

| SDIC & subsidiaries | 6 | 42 | 5 | 1 |

| HongShan | 5 | 54.9 | 2 | 3 |

| CICC Capital | 5 | 195.5 | 3 | 2 |

| Suzhou Capital Group | 4 | 177.1 | 0 | 4 |

| Addor Capital | 4 | 15.5 | 3 | 1 |

| Early Traveller Venture Capital (早行人创投) | 3 | 7.7 | 3 | 0 |

| Legend Holdings & affiliates | 3 | 29.5 | 1 | 2 |

| Optics Valley Industrial Investment | 3 | 3 | 2 | 1 |

| GSR Ventures | 3 | 17 | 2 | 1 |

| CDH Investments | 3 | 55.8 | 2 | 1 |

| CATL & subsidiaries | 3 | 626.1 | 3 | 0 |

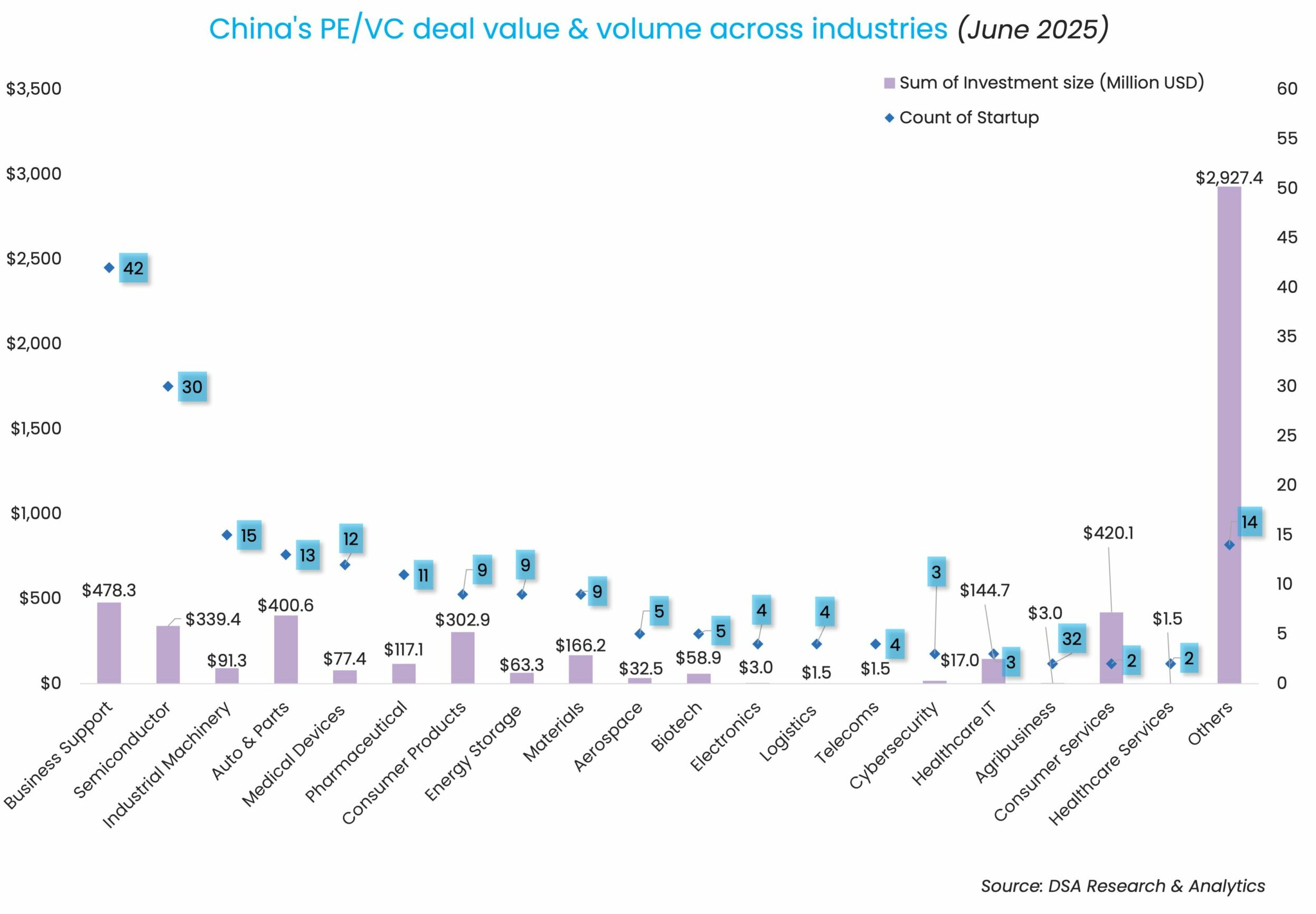

Note: In our monthly analysis for June 2025, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup funding nearly halves in June on megadeal drought

Southeast Asia’s startup funding activity slumped in June, with both equity deal volume and investment value falling sharply from the previous month and a year earlier, dragged by the absence of big-ticket late-stage transactions.

Venture Capital

India Deals Barometer Report: Big-ticket deals drive 40% surge in June funding

Indian startups secured $1.4 billion in funding in June, marking a significant 40% increase over the $1 billion raised in May, largely driven by a few high-value transactions that closed during the month.